Rethinking gas turbines: Supply, speed, and the path to clean baseload power

Speed now defines the power procurement landscape

Electricity demand is rising faster than the systems built to supply it. AI buildouts, data center growth, industrial electrification, and extreme weather are reshaping when and where power is needed. By 2030, U.S. data center load alone is projected to increase 130%. Global electricity use is growing nearly 4% per year, its fastest pace in years.

Clean energy buyers are no longer optimizing purely for cost or emissions. Speed to power is now the constraint, with permitting windows, capital cycles, and policy incentives creating tight, non-negotiable timelines. Buyers need firm, deployable power, and they need it on schedule.

This urgency has exposed a critical gap. The gas turbine supply chain, built for a slower era, isn’t moving fast enough to meet the moment.

The gas turbine backlog is worsening

Power buyers planning new capacity today are staring down delivery timelines that stretch into the 2030s, as lead times for large gas turbines now routinely exceed five years. In some cases, gas turbine OEMs require non-refundable deposits just to reserve a production slot. The industry’s largest manufacturers are struggling to keep pace, and supply isn’t keeping up.

Multiple factors are converging:

Consolidated OEM capacity: Most large gas turbine manufacturing is controlled by a few large incumbents with centralized manufacturing and limited ability to flex production.

Slow production cycles: Traditional gas turbine production is capital-intensive, with long-lead part dependencies.

Global manufacturing constraints: Post-COVID manufacturing backlogs, skilled labor shortages, and material bottlenecks continue to ripple through the industrial supply chain.

A system built for a slower era

For decades, the gas turbine industry was structured for stability, not speed. It optimized for efficiency, cost, and scale, centralizing production in a handful of large facilities and planning capacity around slow, predictable cycles. That model limited throughput and left little room to flex with demand.

Speed to power has become the defining constraint, and legacy players haven’t adapted. The current backlog isn’t an anomaly, but a structural misalignment of a system built for a different era, now out of step with what buyers need.

What’s at stake for power buyers

Power procurement is now a race against time. Delays can cascade into forfeited AI leadership, lost tax credits, missed revenue, climate target shortfalls, or breached delivery contracts.

Projects are being re-scoped or abandoned due to gas turbine delays. Data centers are stalled mid-construction. Utilities are redrafting integrated resource plans not for lack of funding or policy alignment, but because the hardware simply won’t arrive on time.

While strategies like repowering or battery storage can help, they don’t fully solve for increased power demands. Many sites aren’t viable for repowers, and long-duration storage remains cost- and scale-constrained. In high-uptime environments, gaps in firm capacity still require combustion-based solutions.

How Arbor is solving for speed

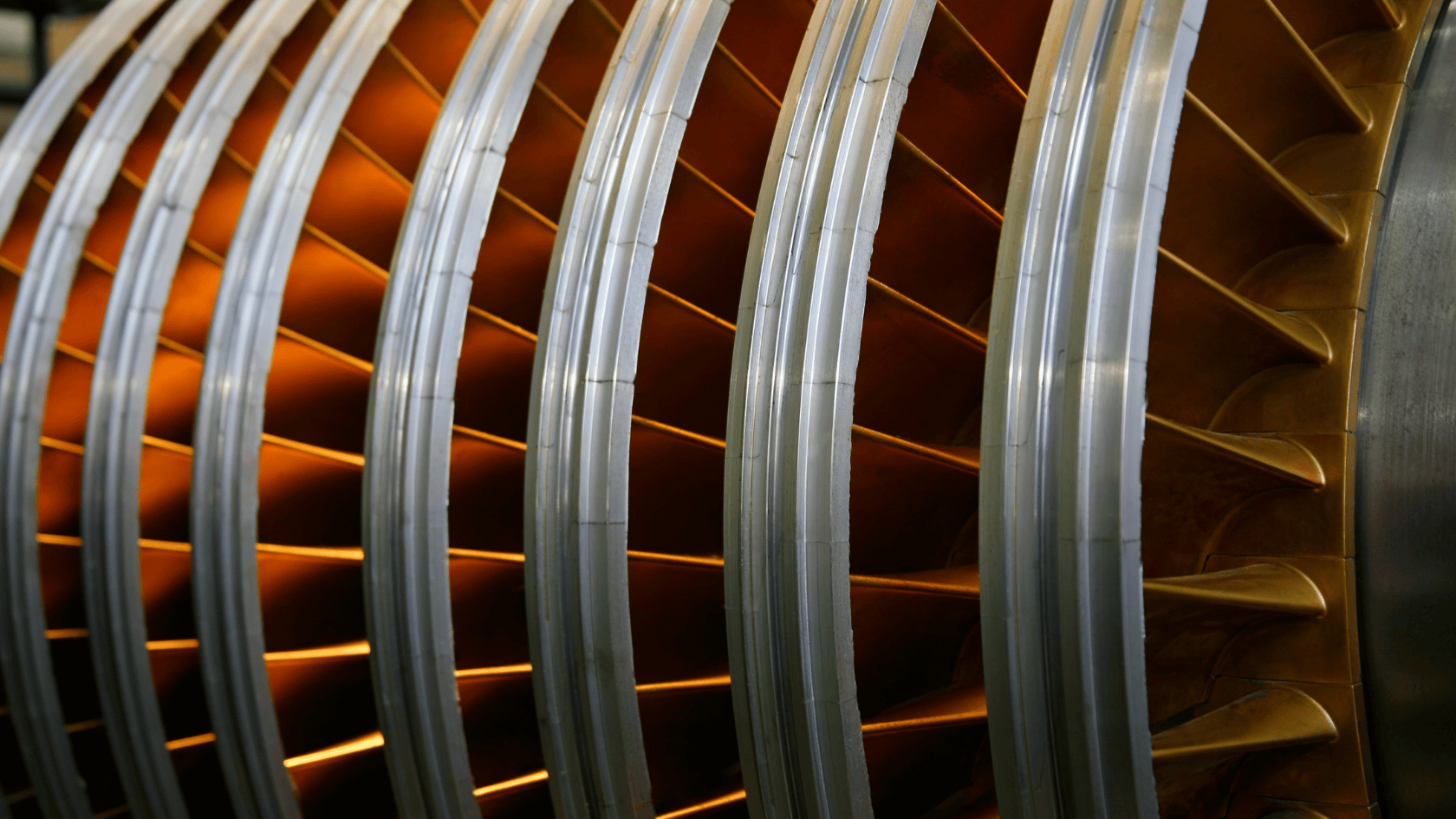

Arbor’s HALCYON system is engineered to avoid the bottlenecks slowing down legacy gas turbine supply. It’s a 25 MW modular carbon-neutral power system that combines high-efficiency combustion with a supercritical CO₂ power cycle and a modern, democratized manufacturing model.

Key design choices include:

Additive manufacturing: Core components are 3D printed, shortening fabrication timelines and bypassing foundry queues.

Democratized production: Our unique, nimble U.S.-based supply chain focuses on throughput and responsiveness instead of centralized megafactories. We’re not limited to traditional power generation suppliers, and we actively source from faster-moving industries like aviation, space, and oil and gas.

Pre-assembled process skids: Major system components arrive on site fully assembled and tested, reducing construction timelines and integration risk. HALCYON’s compact components are also faster to assemble than conventional turbines.

Modular design: HALCYON units can be stacked to scale up over time, offering faster time to power and allowing projects to scale in step with demand or permitting constraints.

Together, these innovations offer the potential for significant reduction in procurement-to-commissioning time compared to conventional gas turbine systems, enabling cleaner, more adaptable baseload delivery.

What to ask when timelines are tight

When time is the constraint, buyers need a clear view of delivery risk. It’s essential to press for specifics on readiness and delivery risk when evaluating suppliers.

Questions worth asking:

What are the actual production lead times, and what’s constraining them?

How much flexibility exists in system sizing, siting, and scale-up?

What does the manufacturing model look like, and how quickly can it respond to volume increases?

How are components tested, validated, and delivered? What can delay that timeline?

What level of emissions performance is designed into the system from day one?

Equally important: does the delivery model align with your commercial timeline, emissions strategy, and site-level constraints

Power systems built for this decade

The gas turbine shortage isn’t going away anytime soon. Conventional supply chains can’t move fast enough to meet what’s ahead, and many projects can’t afford to wait. The energy users driving growth and electrification need systems built for the pace and pressure of this decade.

At Arbor, we’re engineering clean gas turbines that move at the speed this moment demands: efficient, modular, and manufacturable at speed. We believe power buyers shouldn’t have to choose between delivery timelines and emissions goals, and that the people building what’s next shouldn’t have to wait for the power it takes to make it real.

Ready to talk clean baseload procurement? Reach out to our team.